Have your say on proposed changes to the Care and support charging policy

15 December 2021 to 10 February 2022. This consultation is closed. Consultation results and updated policy are available.

Consultation summary and responses

- View a summary of the Care and support charges consultation summary

- View the Care and support charges consultation responses

View the policy

Care and support charging policy consultation

We are reviewing how our Care and support charging policy affects people who receive care and support in their own home, in the community, or have short-term stays in a care home.

We are doing this to make sure we are taking a fair and consistent approach to charging for care, and that everyone pays the appropriate amount for the services they receive, based on their needs and their ability to pay.

We held an online consultation asking for your views on our proposed changes and how they may affect you. We wanted as many people as possible who may be affected by these proposals to have their say. With this in mind we provided an opportunity for you to ask questions about the proposed changes or request the survey in another format.

- Read the background and our proposals below

- Look at the examples which relate to the proposals – and how they may affect what you pay towards care and support

Further information

If you have any questions about this consultation, please email chargingforcare@herefordshire.gov.uk.

Background to the care and support charging policy consultation

Easy Read - Background to the Care and support charges consultation

Unlike the NHS, social care isn’t usually free. The amount of financial support a person may get is based on individual circumstances. We carry out a means-test called a financial assessment to work out how much people pay for care. Some people don’t have to pay anything because of the type of service they get, or because the financial assessment shows they can’t afford to.

There are different rules for charging for care depending on whether a person is receiving care in a care home, or in their own home or other setting. Central government decides how councils must charge for care in a care home, and each council must have its own policy for charging in other settings, but must still follow the regulations and guidance set by government.

Our proposals

We welcome your views on our five proposals and on the information we currently provide for charging and financial assessments.

The proposed changes could affect you if you get social care support from Herefordshire Council and:

- Pay the council a financial contribution towards your social care support at home or in the community

- Pay the council a financial contribution towards a short stay in a care home for up to 8 weeks

- Receive a higher or enhanced rate of disability benefits from the Department for Works and Pensions (DWP)

- Have capital assets above £23,250 and pay the full cost for your care

Our proposed changes

-

Increase the minimum income guarantee amount (MIG) a person is left with after paying for care in line with national means-tested benefits with an additional 25% buffer.

-

Set the minimum income guarantee amount (MIG) for working age people under 25 to the same level as the MIG for working age people aged 25 and over.

-

Remove the discretionary income disregard applied to Disability Living Allowance and Attendance Allowance paid at a the high rate and replace it with an allowance for any disability related expenses paid for private care.

-

Charge for short stays in a care home (sometimes called respite care) for up to 8 weeks over a year under the same rules as paying for care and support in own home, or in the community.

-

Charge people with capital assets over £23,250 the full cost for home care services.

If all of these proposals went ahead we expect 73% of people who are currently paying for care and support at home or in the community will have a reduction in charges, 8% of those people will no longer have to pay for care, and 27% may have an increase in charges.

Currently around 22% of people receiving care and support at home or in the community don’t pay towards it following a financial assessment, 24% of these people may have to pay towards their care and support as a result of these proposals.

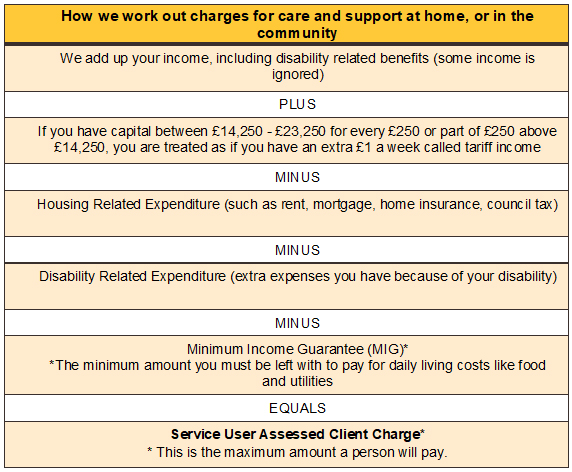

How we work out how much you should pay

We work out the amount you should pay towards care and support at home or in the community by carrying out a financial assessment. This takes account of income (like benefits and pensions), savings and assets (like stocks and shares), household costs (like mortgage, rent, and council tax), and any disability related costs you have to pay.

You will pay the full amount for any agreed care needs provided by the council, up to a maximum of your assessed weekly charge. If your care costs are more than your assessed weekly amount you will pay only your assessed weekly contribution. The council funds the difference.

For example:

If your care costs less than your maximum client charge

- The council pays £60 a week for you to attend community activities for two mornings a week.

- Your assessed weekly contribution is £73.25

- Because your costs are less than your maximum weekly contribution you will pay the full amount - £60 a week

If your care costs more than your maximum client charge

- The council pays a home care provider £188 a week for you to have 10 hours of care at home.

- Your assessed weekly contribution is £73.25

- Because your care costs more than your weekly assessed contribution, you will pay £73.25 a week towards this.

Our local policies on how we treat income

When councils decide to charge for care and support in settings other than a care home they may choose to disregard additional sources of income, set maximum charges, or charge a person a percentage of their disposable income.

We can also use our discretion in some areas, but we must follow the Care and Support (Charging and Assessment of Resources) regulations and have regard to the statutory guidance.

Currently we:

- Disregard £29.60 of weekly income received by people getting disability living allowance (DLA) or attendance allowance (AA) benefits paid at a higher rate where the council is only providing care and support during the daytime.

- Set a maximum charge for home care services based on the urban rate paid to home care providers. This means that people eligible for council funded home care pay the same rate for care whether they live in urban or rural areas.

- Take 100% of disposable income above the minimum income guarantee amount when setting charges.

- Provide telecare services free of charge for the first 6 weeks.

- Where the council is meeting the needs of a carer by providing a service directly to the carer, it is provided free of charge. We recognise the significant contribution that a carer makes to help maintain the health and wellbeing of the individual they care for, as well as supporting the individual’s independence and enabling them to stay in their own homes for longer.

We are proposing to:

- Remove the £29.60 income disregard from DLA and AA, but include the cost of any private care to meet needs as a disability related expense instead.

- Apply charges for people with capital assets above £23,250 based on the full cost paid to the home care provider. This means people who live in rural areas who should self-fund their care will pay the same rural rate the council pays home care providers.

- Take 100% of disposable income above income support or pension credit benefit levels, with an additional 25% buffer (these are over and above the minimum income guarantee amount set by central government).

We propose to continue to:

- Setting a maximum charge for home care services for people eligible for council funded care so people pay the same rate for care whether they live in urban or rural areas.

- Providing telecare care services free of charge for the first 6 weeks

- Providing services to carers free of charge.

Minimum income guarantee

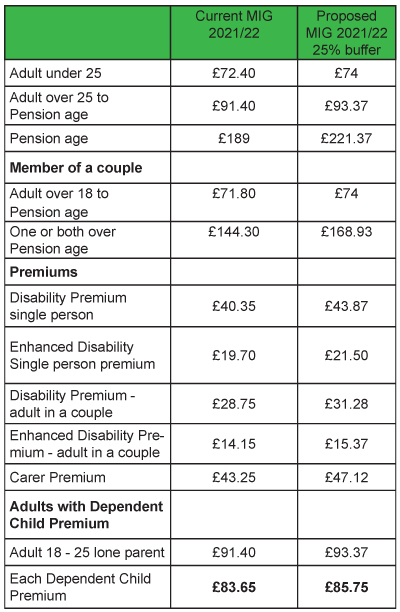

A person must be left with a minimum income guarantee (MIG) after paying charges for care to pay for daily living costs. The Department for Health and Social Care (DHSC) publishes this amount every year. View the current figures.

- We are proposing to increase the MIG amount for people of working age and pension age in line with income support or pension credit levels, with an additional 25% buffer

The table below gives some examples of the difference between the current MIG published by the DHSC and a minimum income guarantee based on DWP income support/pension credit allowances and premiums for 2021/22.

If the proposed changes go ahead from 11 April 2022, the MIG amount shown above with the 25% buffer will increase in line with DWP uplifts to benefits and pensions for 2022/23.

Where a person receives benefits to meet their disability needs, the charging arrangements should ensure that they keep enough money to cover the cost of meeting these disability-related costs

Disability related expenses

When we carry out a financial assessment we ask about what extra costs people have to pay because of their disability or illness. We call these disability related expenses (DRE). We can include these expenses if we see proof of payments made and the costs are reasonable.

We know from feedback that sometimes it is hard to know what sort of things can be treated as disability related expenses so we are proposing to include more examples in our policy. See our page on disability related expenses for more information.

Supporting documents and more information

To help you with your response, here are some more facts and information that may be useful to you.

- Currently around 78% of people in Herefordshire are paying towards care and support received in the community or at home, around 22% do not have to pay following a financial assessment.

- Around 100 people with capital assets above the funding limit have chosen to ask the council to arrange care and support for them at home or in the community, 14% live in rural areas where the council pays home care providers more money to deliver care.

- In the last financial year Herefordshire Council spent just over £29million providing care and support to almost 1,900 people in their own home or in the community, including people who had direct payments to buy their own care, and it charged just over £4.1million in service user contributions towards that cost.

For more information about how we currently charge for care and support visit our Paying for care pages.